Purplle, the online beauty and grooming platform, secured $120 million in funding led by the Abu Dhabi Investment Authority (ADIA) in July 2024. This investment follows a notable 43% increase in revenue for the fiscal year ending March 2024 (FY24), reflecting substantial growth and financial progress.

The Mumbai-based company reported a revenue surge to Rs 680 crore in FY24, up from Rs 475 crore in FY23, according to its consolidated financial statements from the Registrar of Companies (RoC). The company’s revenue growth was driven by its dual business model: a marketplace and its proprietary brands, including Faces Canada and Good Vibes. Primary revenue sources included advertisement and visibility services, sales from its own brands, royalties from sellers, subscriptions, and support services.

Purplle also generated Rs 45 crore from interest on investments, raising its total income to Rs 725 crore in FY24, compared to Rs 509 crore in FY23. On the expense side, advertising and business promotion costs constituted 25% of total expenses. This expense decreased to Rs 209 crore in FY24 from Rs 266 crore in FY23. Additionally, the company experienced a 12% increase in employee benefit expenses due to workforce expansion.

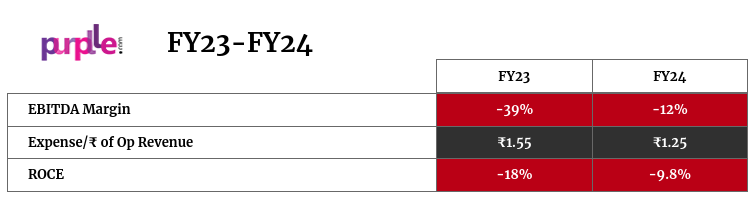

Overall expenditure rose to Rs 850 crore in FY24, up from Rs 738 crore in FY23, driven by spending on materials, rent, IT, legal services, secondary packaging, transportation, and other miscellaneous costs. Despite increased expenditure, Purplle’s strategic focus on controlling advertising costs contributed to a 46% reduction in losses to Rs 124 crore in FY24, down from Rs 230 crore in FY23. The company also saw improvements in its Return on Capital Employed (ROCE) and EBITDA margin, which reached -9.8% and -12%, respectively. On a unit basis, the company spent Rs 1.25 to earn one rupee in FY24.

As of March 2024, Purplle reported cash and bank balances totaling Rs 109 crore. With its recent substantial funding, robust growth trajectory, and improving margins, Purplle appears well-positioned for continued success. However, it faces significant competition from established players such as Nykaa and Mamaearth, which have gone public. Owning and effectively managing profitable brands remains crucial for success, and Purplle’s performance in this area suggests promising growth prospects. There is potential for further margin improvements and possibly an IPO in FY26.